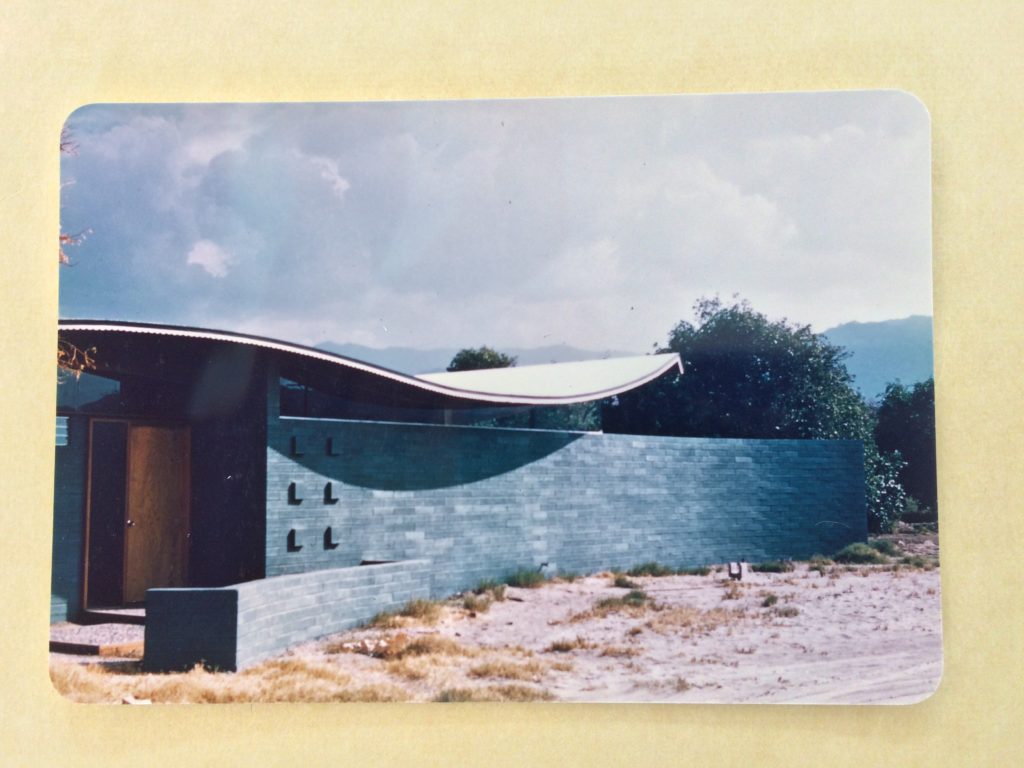

Miles C. Bates house, Palm Desert, CA, 1954-5.

Images courtesy of Architecture and Design Collection, Art, Design & Architecture Museum, UC Santa Barbara.

© UC Regents.

The Desert Sun earlier this month reported a decision by City Council, on advice of City Staff, to formally object to the Historical Society of Palm Desert (HSPD) submission for the nomination of the Miles C. Bates House to the National Register of Historic Places. The general concern was that the City would lose statutory control of the property to the federal designation.

A specific concern was heard that a national designation would tie the hands of the City should a future owner decide the structure prevented the land’s highest and best use, and wish it demolished. This is not the case. According to 36CFR1.60.2, “Listing of private property on the National Register does not prohibit under Federal law or regulation any actions which may otherwise be taken by the property owner with respect to the property.” If it is an income producing property that has received federal tax preservation incentives, other rules apply.

For those of you not familiar with the Code of Federal Regulations, Part 60 contains the nomination procedures for the National Register of Historic Places. Federal regulation 36CFR1.60.6b considers only those objections for nomination coming from owners of private property. The Miles C. Bates House is not owned by a private entity or citizen, but by a public agency.

If the City has not yet lodged an objection, it may decide not to, as it would have no material effect on the outcome. Presumably the historical designation of worthy properties is in the general interest of the public and by definition, the public entity owners of such properties, so such objections are not grounds for rejection. It is difficult to understand the apparent disregard for those who contributed thousands of dollars to the HSPD for the National Register nomination.

The City is planning its own historical designation. The State Office of Historic Preservation rules and regulations oversee both or either the City’s historic designation and the HSPD application for nomination to the National Register of Historic Places, in terms of eligibility under the Mills Act.

The HSPD application is underway because it and its supporters believe the property is not only of local importance, but also of national stature. It is also a safeguard if, for any reason, should the City decide to abandon or reverse its local historic designation.

Miles C. Bates House to the National Register of Historic Places

Courtesy of the Palm Desert Historical Society

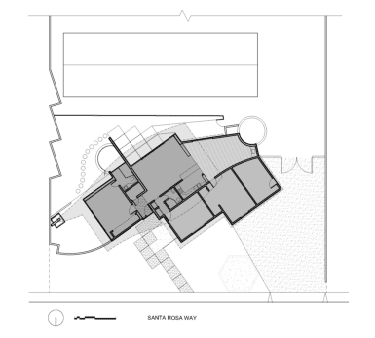

Drawing by Chris Ward © 2017

Click here for the full page.

When the State Historical Resource Commission votes to approve the HSPD nomination, it is sent on to the Keeper of the National Register in Washington DC, where the state approval is in turn approved, or rarely, declined.

The Desert Sun also reported a City concern that national designation will result in “costly renovation restrictions that would deter potential buyers”, by “the far more restrictive national designation” and “the rigid rules to restore it to its exact original condition (would make it) not financially viable”.

The federal standards of rehabilitation are published as Guidelines. There are four levels of recognized treatment – preservation, restoration, rehabilitation, and reconstruction. Rehabilitation is the most popular as it provides flexibility, encouraging appropriate repair, making alterations that meet contemporary needs, but do not compromise architectural integrity.

Neither does the California Historical Building Code impose standards that should make the property inviable.

It provides alternative performance standards the City can use for the issuance of rehabilitation construction permits.

Both the Guidelines and the Code are designed to repair and protect the main features of historic properties at a reasonable cost, while maintaining public safety. They do not require the property be “restored to original” nor brought up to “modern code”. The Historical Society envisions and encourages this approach for this property.

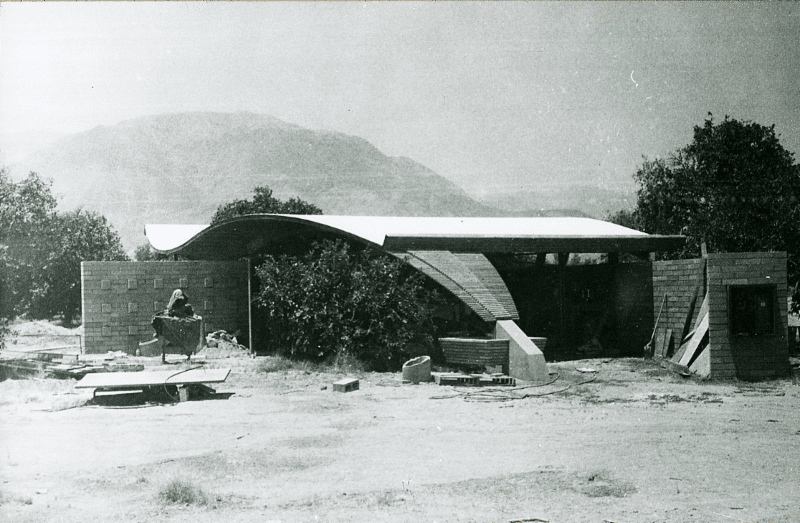

Miles C. Bates house, Palm Desert, CA, 1954-5. Under Construction

Images courtesy of Architecture and Design Collection, Art, Design & Architecture Museum, UC Santa Barbara.

© UC Regents.

The City seems to be making the worst of choices. It wants to reject the national designation that would increase the value of the home with its unique features, in favor of a City designation it believes it can cancel at any time. In fact, the City can revoke either at any time, but will still require hearings on either to determine the public good.

City support is essential for it does provide more protection to historic resources than the State or Federal Government, because it regulates demolition and is more specific to a community’s values and resources. The National Register designation does not preclude demolition. It does add prestige to the City’s excellent works of Mid-Century Modern architecture.

The Sale

The City did not have it appraised as the cultural asset and historic architectural property it is actively pursuing. In such an appraisal, the value determination would be realistically like that of a run-down “fixer”, minus the cost of rehabilitation. That would significantly decrease the value, and leave a Buyer funding room for rehabilitation.

The home will be featured during Modernism Week this coming February, when the City will auction it. Presumably, the City hopes the additional publicity will help fetch a higher price. By that time the national nomination will be approved or not.

We have been told the City avers that for legal reasons it will be sold to the highest bidder, historically minded or not, and without conditions to rehabilitate or even retain the historical features.

City Council should also hope it is not sold to a multi-family dwelling developer who can turn around and legally request a demolition permit to make way for new construction. The City could impose conditions on the sale that guarantee the property will be preserved as it should be, such as a covenant or a performance bond for rehabilitation, but because of the high appraised value it is unlikely there would be reliable takers or follow-through.

There is no doubt this home is architecturally significant. The preservation of cultural resources is a City mandate, not an equivocal process that may or may not achieve that objective. The City can purchase the property as an important local asset, have it re-appraised and sold or donated for its true purpose and value. When done, a non-profit such as the Historical Society, or an individual who is demonstrably willing and able to dedicate money to its rehabilitation, possibly as a single-family home, can be relied on to preserve this piece of history.

The City should address unexpected or unwanted outcomes and their effect on the fate of the Miles C. Bates home. It should not include demolition or demolition by neglect by any party.

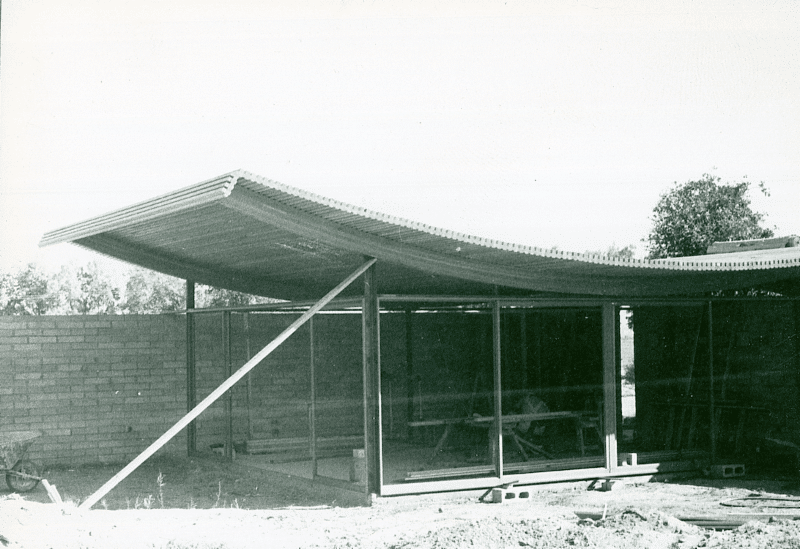

Miles C. Bates house, Palm Desert, CA, 1954-5. Under Construction Images courtesy of Architecture and Design Collection, Art, Design & Architecture

Museum, UC Santa Barbara.

© UC Regents.

_______

Clarification and Expansion of Comments by Wayne Longman to the Palm Desert Cultural Resources Preservation Committee Regarding the Miles C Bates House 12/12/2017

Summary

The sale of the Miles C Bates home would benefit by providing potential buyers with more accurate information about the property, including the costs and benefits of a historic designation, thus increasing the buyer pool to achieve a higher auction price.

Designation

When City Council approves the Miles C Bates home for designation as a Palm Desert Landmark, it will be eligible for protection from the City through its Municipal Code, code enforcement and control of demolition.

This protection will “promote the public health, safety, and general welfare by providing for the identification, designation, protection, enhancement, perpetuation and use of cultural resources that reflect themes important in the city’s history” (PDMC 29.01.010)

It will add prestige to the City’s excellent works of Mid-Century Modern architecture, and may serve as a public focal point of that heritage.

A future Buyer may become eligible for significant property tax reductions under a Mills Act contract, provided they undertake work to restore the original footprint of the historically significant portion of the property.

The Existing Appraisal

The City has made public an appraisal that was done to determine its “highest and best use”.

At the time of the appraisal it was speculated that the home would become eligible for a Mills Act tax reduction, and an amount for that was included in the valuation.

There are a few problems with the appraisal.

In terms of being a historical property, it does not contain, indicate, or specify:

- drawings and dimensions of existing structures and their placement on the lot;

- floor plans of the additions to the original structure;

- of the nearly 4,000 sq.ft. of structures, the historic portion of the structure is only about 600 ft.;

- to obtain the Mills Act tax reduction, the requirement and cost of demolition of most of the structures and repairs to re-establish the 600 sq.ft. footprint;

- the cost of rehabilitation to preserve and enhance the building and architecture;

- the real estate re-sale premium that would result from rehabilitation.

The highest and best use appraisal positions the property as a multi-family rental. That also has problems in that adjustments are overpriced:

- since the Appraiser was not given access to the interiors, comparable sales were used to determine value that ranged in fair, average or superior condition. In fact, the interiors have been vandalized, and are in poor condition;

- exterior areas are cramped and lacking views, in contrast to the comparables;

- the amounts included for bringing the property to a habitable condition would not cure the ad-hoc changes that make the property an eyesore as well as a low-end rental property that would not be permitted today;

- The Mills Act tax reduction premise does not mention the cost of demolition or loss of rental revenue;

- The valuation premise as a rental property appears to contradict the City’s historic designation, so an investor may expect the City to issue a demolition permit for part or all the property so he can make better, the best and highest use.

A New Appraisal

A new appraisal that fully explores the historic designation aspects of the home is essential to

- show the City fully supports its continued existence as a historic property;

- remove the perception the City prefers use as a rental property with a tax benefit;

- create a valuation and market value that includes the cost factors of the true condition, and of the required demolition and rehabilitation;

- outline the local and federal tax opportunities and obligations.

This appraisal need not repeat or revise the highest and best use appraisal, as that work has been done and has served its purpose. The new appraisal would best be done by an Appraiser experienced with historic buildings.

The benefits of an “Historic Appraisal”:

- demonstrate the wishes of the City for a rehabilitated historic property;

- well informed buyers;

- bring all potential buyers to a common level of understanding;

- show investors the amount of expenditure and change required to obtain the Mills Act tax relief;

- bring back historically-minded buyers who are known to be discouraged by the City’s consideration of it as a conventional multi-family rental property, and the resultant price;

- increase the number of potential buyers, resulting in more bids and a higher price.

The Auction

The final auction price will be determined by the Buyer based on their own cost-benefit criteria with the appraisal prices being only one factor. However, removing appraisal unknowns should increase buyer confidence, encourage the number of bidders and bids, reduce the amount they hold back to deal with unknowns, and increase the sale price.

As structured now, the Auction is positioned as an “As-Is, Buyer Beware” sale, which requires the Buyer to assume responsibility for discovering any hidden future costs. This can discourage a potentially large number of buyers who are not professional real estate buyers. Even professionals will reduce their bid amounts to cover this uncertainty.

To give all parties equal chance, and to increase the pool of bidders, potential buyers should include private citizens who are not professional real estate investors, and those who learn of the property for the first time during MW, or those interested who cannot attend the auction in person, who may be the ideal buyer, but not have the time, expertise or contacts for investigation.

Fear and doubt issues can be overcome by using relatively simple parts of the process used for ordinary residential purchases in California, and that is, the Seller discloses known faults to the potential Buyer.

One California Real Estate company that does online auctions of residential properties has the following standard documents, as applicable, prepared before the auction, that are given or emailed to all potential Buyers:

- Preliminary Title Report

- Termite Inspection

- Home Inspection Report

- Natural Hazard Disclosure

- Seller Property Disclosure/Transfer Disclosure Statement

- Carbon Monoxide/Water Heater/Smoke Detector Disclosure

- Lead Based Paint Disclosure

- Residential Earthquake Hazards Disclosure

- Statewide Buyer/Seller Advisory

- Market Conditions Advisory

Buyers are also invited to bring their own inspectors, but armed with these most are satisfied with a visual inspection, which are held all on the same day.

To further allay fears, particularly from those out-of-state, the City might adopt this and might also agree to use standard California Residential Purchase contracts, and to allow Buyers to be represented by real estate agents.

These should also help remove the auction from the realm of real estate speculators, who often prefer to work with unknowns when it gives them a competitive advantage, and who are less likely to preserve.

Conclusion

A new appraisal is essential to cure and update information about the historical property that may mislead or turn away buyers. This is seen to bring additional buyers, increase competition and the final sale price, as is the possible use of conventional residential real estate documentation for the auction.